Оставь свой "Автограф" километрами счастья на автостраде жизни!

Оставь свой "Автограф" километрами счастья на автостраде жизни!

DACA (Deferred Action for Childhood Arrivals) are a government system designed for undocumented people brought to the newest You while the college students who had been elevated from the U.S. and you may prierican, even though they are currently in the country unlawfully. He could be sometimes described as DREAMers because they take advantage of the Creativity, Rescue, and you will Knowledge getting Alien Minors Act, hence features short term conditional abode on the right to work.

Since 2021, there are several form of home loans offered to DACA readers, together with FHA fund. Let’s look at just how DACA recipients can buy an enthusiastic FHA financial and get property that have undocumented reputation.

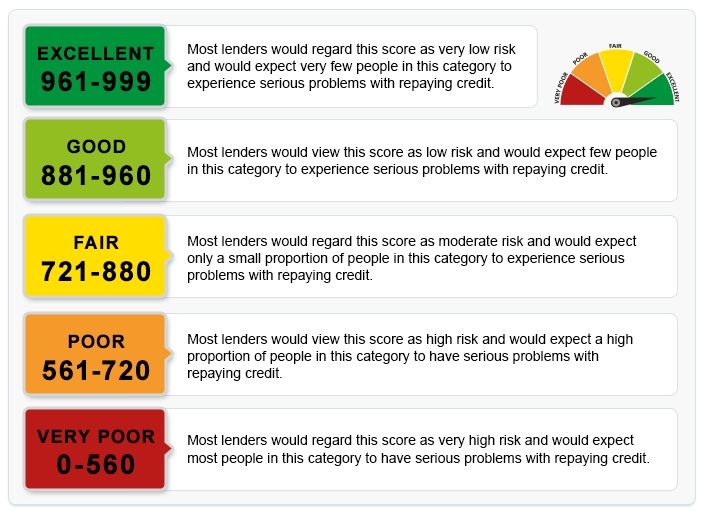

When it comes to acquiring a mortgage, DACA recipients are eligible having FHA financing. These financing let them buy property when you are living in the usa with undocumented updates. FHA financing has actually the requirements that have to be met, like having the very least credit history regarding five hundred and you will paying an insurance coverage superior initial to fund certain risks with the loan. By facts these conditions and researching different loan providers, DACA recipients find that loan that meets their economic needs and you may makes it possible for buy a home.

DACA (Deferred Step getting Youth Arrivals) is a program built to manage undocumented individuals who had been brought on the United states as children. The program was created by National government inside 2012, therefore will bring a short-term reprieve out of deportation and has recipients the right to work lawfully inside the United states. DACA grantees was provided a two-seasons sustainable age deferred step, when they may be able sign up for a work allow and other positives particularly knowledge recommendations and you may driver’s licenses.

Very first, individuals you certainly will request DACA condition if they involved the new You.S. in advance of turning sixteen, constantly lived-in the world because , and were according to the age of 29 with the . DACA users in addition to don’t has actually a criminal history or any sort regarding criminal history.

There is certainly specific misunderstandings on which defenses the application does and you can doesn’t promote. DACA will not pave the way in which getting recipients to find legal citizenship, neither does it allow it to be readers to locate legal reputation through a good charge or eco-friendly cards, however, members can be replenish DACA qualification if dos-year label expires and you will consistently stay in the country as the a lot of time as his or her status constantly renews.

Brand new DACA system was first brought beneath the National government into the 2012 through exec action just after Congress failed to ticket the newest Dream Act one to same year. In the course of its innovation, more 1.seven million undocumented individuals were qualified to receive the DACA program relief. As system was made around professional action, the newest legality of one’s DACA system could have been confronted via lawsuit several times regarding the decades just like the the first.

While in the his cuatro-12 months label, Chairman Donald Trump did to avoid DACA. While he avoided the fresh DACA software for the 2017, President Trump was never ever able to eliminate the DACA system totally.

Into the his within the, Chairman Joe Biden closed multiple exec purchases to help you overturn Trump-time mandates pertaining to immigration. On top of that, on inauguration big date, President Biden delivered the latest U.S. Citizenship Operate out-of 2021 so you can Congress, and therefore signaled his administration’s solid service for DACA program defenses and you may intricate operate in order to fast-song DACA readers, or DREAMers, on lawful citizenship.

At the beginning of 2021, upon the alteration of one’s presidential management, this new Federal Houses Management (FHA) granted a huge switch to its plan with the home loans having DACA recipients. In the past, those people versus lawful home were unable discover a keen FHA loan.

The fresh new debtor need to be eligible to are employed in the fresh U.S. and offer a jobs Authorization Document (EAD) saying for example towards the lender.

A whole lot more options are probably be extra as almost every other organizations revision the policies, especially in light regarding altering presidential administrations and you will political feeling. However, listed here is a recently available selection of most of the home loan choices for people on DACA system.

Conventional loans are among the top options for DACA receiver discover a home loan. Such loans normally have highest borrowing conditions than simply regulators-supported apps, however, this allows these to be much more versatile with regards to off financing types, structures, and you may prices. Having conventional money, consumers need meet specific money requirements to be considered — usually consumers is always to secure about two-and-a-half moments its monthly loans Stewartville AL mortgage repayments to become recognized.

As previously mentioned, FHA loans are actually designed for DACA borrowers. FHA money require a little lower credit ratings than traditional loans manage, together with less down payments. But not, they also come with large charges and additional insurance premiums.

Federal national mortgage association Conforming Funds was mortgage loans open to DACA readers you to definitely qualify necessary for Fannie mae. These types of fund tend to come with fixed prices and possess reduce percentage standards than many other kind of mortgages. As well, consumers generally you would like at least credit history out of 620 to be considered to own a fannie mae financing, and also a debt-to-earnings proportion out of forty-five% or less.

The new U.S. Service out of Farming (USDA) will bring mortgage loans of these staying in outlying and you may partial-outlying section, and you may DACA receiver are now able to qualify for these types of mortgages as well. Such funds feature zero deposit conditions but possess money constraints which vary according to place.

Finding the right DACA loan selection for you will be a keen daunting carrying out. To ensure that the application suits the needs of all loan providers, it is critical to very carefully search each choice and you may see the official certification and you will masters given by each one. Create home ownership a reality to your better DACA choice to you.